How Do Car Loans Work Philippines

A car loan allows an individual to buy a vehicle that is more expensive than what could be afforded in a lump sum or cash purchase. Consumers have to remember though that interest rate for used cars is bigger than the new ones.

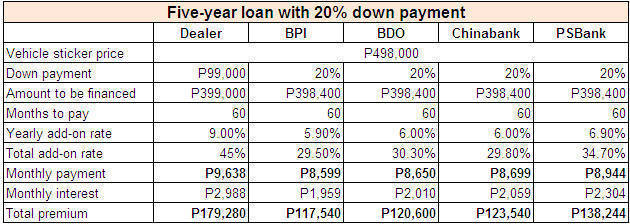

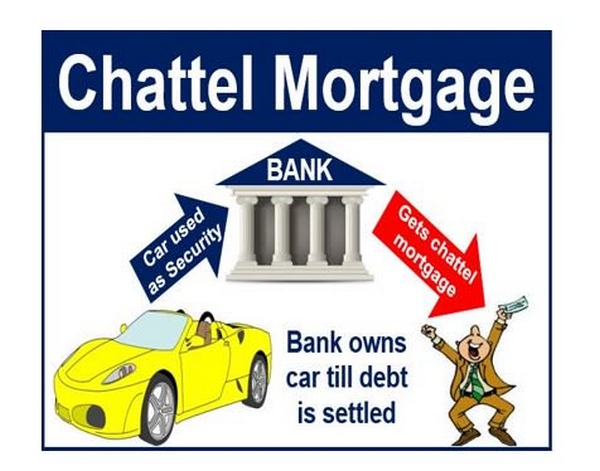

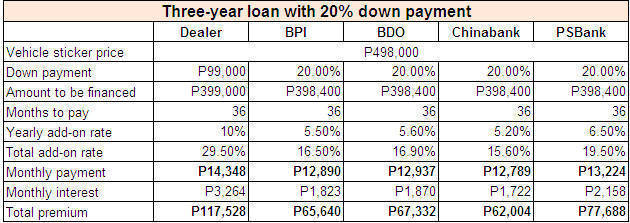

The Best Car Loan Deals In The Philippines For 2021

Pick the right loan term.

How do car loans work philippines. Check out my video for the things you need to know. You will be assisted with the next steps to avail your car loan and we will help you through the process. When you approach a lender seeking a car loan the lender will look at your credit report and income to determine whether or not to grant you the loan.

With the help of financial institutions in the Philippines a person can acquire a vehicle at more affordable payment terms which is usually in an installment basis. Also check. Secured car loans are far more common in the Philippines where a borrower pays for the automobile on an installment basis and when he she falls behind in repayment over several months the loan provider will repossess the car as compensation.

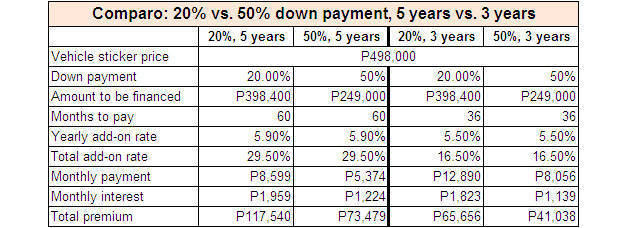

Breaking it down to the last peso. You have to consider the type of car youre going to buy your budget and your qualifications. The bank will call your personal number provided and if applicable.

Apply online here now here on this website. It would help if you spent it on needs like food water electricity shelter and education. This is why researching and comparing auto loans matter a lot before you apply for a car loan.

ANNA CAMSTwitter Instagra. This process lets the applicant know whether they are ready to apply for a car loan or not. Of course for the first-time buyer navigating the maze of financial instruments for in-house dealership financing bank.

Be a responsible borrowerstart off by making sure you meet the. In addition a co-maker is also used when the borrower doesnt meet the credit criteria such as age or if hisher income is insufficient for the loan. It would also inform the applicant about how much the bank is willing to lend him based on his financial capacity.

Car financing in the Philippines for a used vehicle can also be financed in a traditional way straight line or pay the premiums 30 days in advance to gain a lower interest rate. If no you might need a higher paying job as cars arent a top priority. Apply for the Car Loan.

Decide on the car you want to own. In the event that the borrower doesnt meet the minimum monthly income a co-maker s income can be included. Banks are lending out money more readily with flexible terms and payments.

We are dedicated to helping working Filipinos and OFWs abroad get their new car as quickly and easily as possible. How to Apply for a Car Loan in the Philippines Step 1. How much can you afford to pay on a car loan.

Compute How Much You Can Borrow. One of the big drivers behind the growth in sales in the automotive industry is easy credit. Car Loans is what we do.

Your place of work phone number. Steps on How to Get a Car Loan in the Philippines. Car dealers usually has in house financing.

Auto loan providers in the Philippines offer different features and promos that cater to the needs and preferences of different car buyers. This website has been designed and built so that applying for car loans is now easier than it has ever been all across the Philippines. OFW E-Card will speed up verification if you have one then your verification can be simplified as banks can gather your employment information from the OFW E-Card database.

Choose between Bank or Dealer Financing. The auto-loan prequalification process. While banks in the Philippines have different bank car loan offers.

How Car Loan Works in the Philippines How a car loan works is quite simple. Its a financing scheme in which the bank or a financial institution lends you a specific amount so you can buy a car. With unsecured car loans the lending bank does not reposses the car but instead charges a very high interest fee for the remaining tenure of the car loan.

Check if Youre Qualified for an Auto Loan. Youll then be paying the borrowed amount in a series of monthly payments over the tenure or period of the loan normally between 12 and 60 months. If you cant afford a onetime payment then getting a Car Loan in the Philippines is easy.

Online loans work the same way as bank loans but the transaction is handled online instead of in a brick-and-mortar lending office. Make sure you understand the terms of the loan. Planning on buying a car.

How to get an alternative car loan if denied in the Philippines. Filipino citizens between 21 but not more than 65 years old when the loan matures with a joint monthly income of at least P30000 P40000 for some banks may apply for a car loan. According to Tamayo 2013 in house financing often costs 4-5 more than bank financing.

According to the Bangko Sentral ng Pilipinas BSP a co-maker is a person who promises by written contract to pay another persons loan in the event heshe fails to do so. Once you completely repay the loan and interest rate the mortgage will be cancelled. Key car loan features in major Philippine bankss.

Shop around and compare rates. Car financing 101. Chattel mortgage is also a type of car financing in the Philippines.

Most car loans in the Philippines are secured that is to say if you miss a certain number of monthly payments the bank has the right to repossess your vehicle. Thank you so much for watchingFacebook Page. Getting a Car Loan.

Car Financing Philippines Breaking It Down To The Last Peso

How To Get Approved For A Car Loan In The Philippines

How To Get A Car Loan In The Philippines Autodeal

The Best Car Loan Deals In The Philippines For 2021

Car Loans How To Get Approved Fast In The Philippines Complete Guide

How To Get Approved For A Car Loan In The Philippines

The Best Car Loan Deals In The Philippines For 2021

How Car Loan Works In The Philippines Guide For First Time Car Buyers

The First Time Buyer S Guide To Car Loans

Auto Loan Frequently Asked Questions Bdo Unibank Inc

How To Get A Car Loan In The Philippines Autodeal

Car Financing Philippines Breaking It Down To The Last Peso

The Best Car Loan Deals In The Philippines For 2021

Car Loan In The Philippines What To Do After Full Payment

Car Loans How To Get Approved Fast In The Philippines Complete Guide

Remember These Things When Applying For A Car Loan In 2021

How Do I Qualify For A Car Loan Experian

Car Financing Philippines Breaking It Down To The Last Peso

How Car Loan Works In The Philippines Guide For First Time Car Buyers

Post a Comment for "How Do Car Loans Work Philippines"